Pay rate calculator qld

IPadiPhone friendly QLD Stamp Duty Calculator to calculate stamp duty in Queensland TOP-10 property values in QLD for the current month. This calculator is an estimate.

Queensland Health Hourly Pay In Australia Payscale

This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

. Learn about workplace entitlements and obligations for sick and carers leave COVID-19 vaccinations PCR and rapid antigen testing and more. Your salary - Superannuation is paid additionally by employer. Developers can have better.

This calculator is always up to date and conforms to official Australian Tax Office. June 2023 the value of land that you own in another Australian state or territory may be included when determining the rate. Brisbane influenced data the most obviously but heres the most popular pay calculations in Queensland last year.

Tax band is 600000999999 Tax calculation 500 1 cent 80000 excess 500 800 Tax payable 1300 Example 2 Total taxable value of 6400000 Tax band is. Calculate your liability for periodic annual and final returns and any unpaid. Use this calculator to quickly estimate how much tax you will need to pay on your income.

Take home pay 661k. Enter the relevant data and click. Total Queensland taxable wages -.

It can be used for the 201314 to 202122 income years. Calculating payroll tax You can work out how much payroll tax you need to pay that is your payroll tax liability by using this formula. Annualfinal liability payroll tax calculator help.

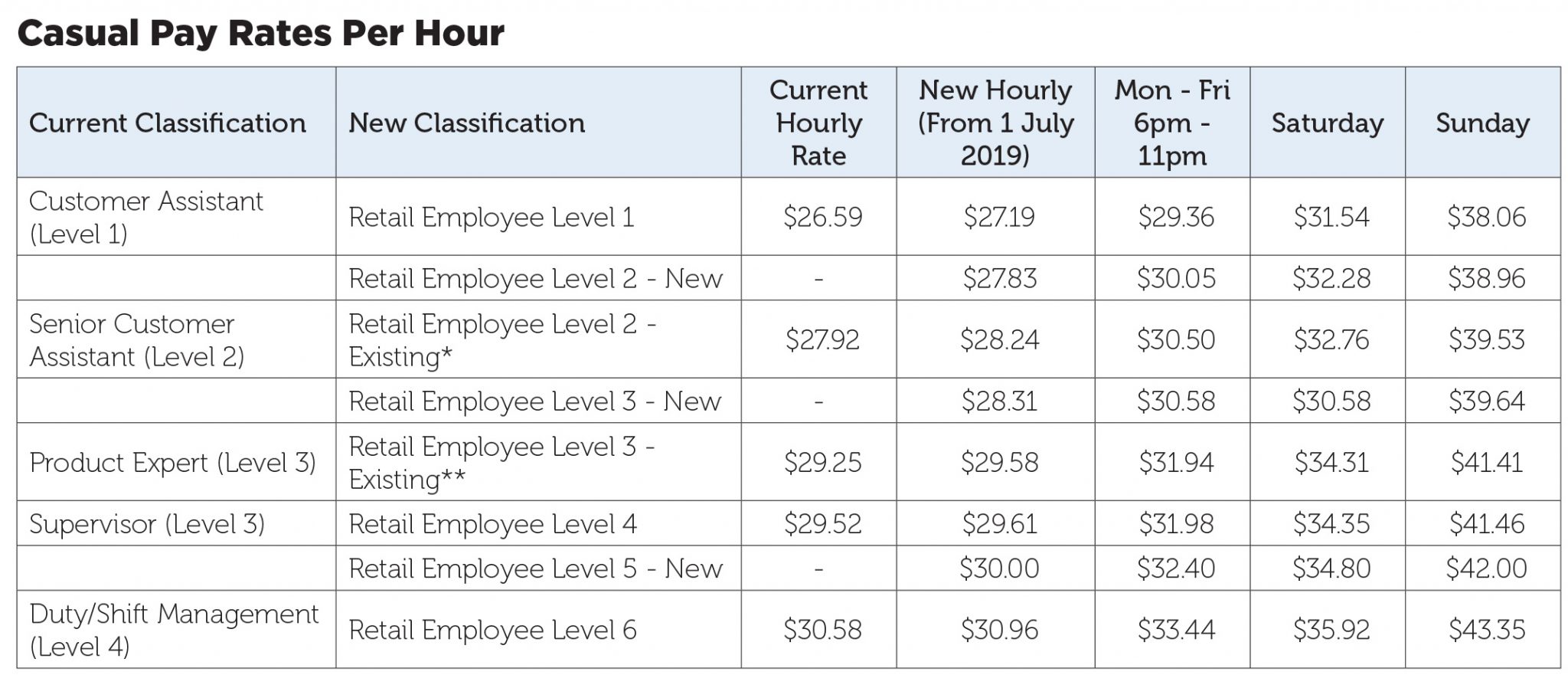

After 6pm Monday to Friday. This calculator now conforms to the Australian Tax Offices Pay As You Go PAYG schedules. Employees need to be paid the right pay rate for all time worked including time spent.

ATO fortnightly tax deductions -. 495 for employers or groups of employers who pay more than. Your weekly compensation payments are based on the wages you received from your current employer in the 12 months before your injury.

Social Community Home Care and Disability Services Industry Award MA000100 Pay Guide For employees in Queensland whose employers are non-constitutional corporations use our. The payroll tax rate is. Learn how the taxable value of land is used to calculate land tax.

As of 1 July 2022 the National Minimum Wage is 2138 per hour or 81260 per week. Employees covered by an award or registered agreement are entitled to the minimum pay. 3 You are entitled to 25000 Low Income Tax Offset.

Check to see if you are covered by an. Opening and closing the business. Calculating normal weekly earnings.

Stamp Duty Calc. What are the most common pay calculations in QLD. Pay rate doesnt look right.

475 for employers or groups of employers who pay 65 million or less in Australian taxable wages. Once again if your employer uses ATO tax tables to calculate your pay you will be overpaying 67 in tax if you earn 87000 per year and getting paid fortnightly. The calculator helps you to self-assess your annual or final payroll tax liability.

Payroll tax calculators You can use our calculators to determine how much payroll tax you need to pay.

P A C T Pay Calculator Find Your Award V0 1 108

How To Calculate Your Digital Agency S Charge Out Rate Sbo

How Much Should I Charge As A Consultant In Australia

2

Aus Processing State Payroll Taxes For Australia

Pay Calculator

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

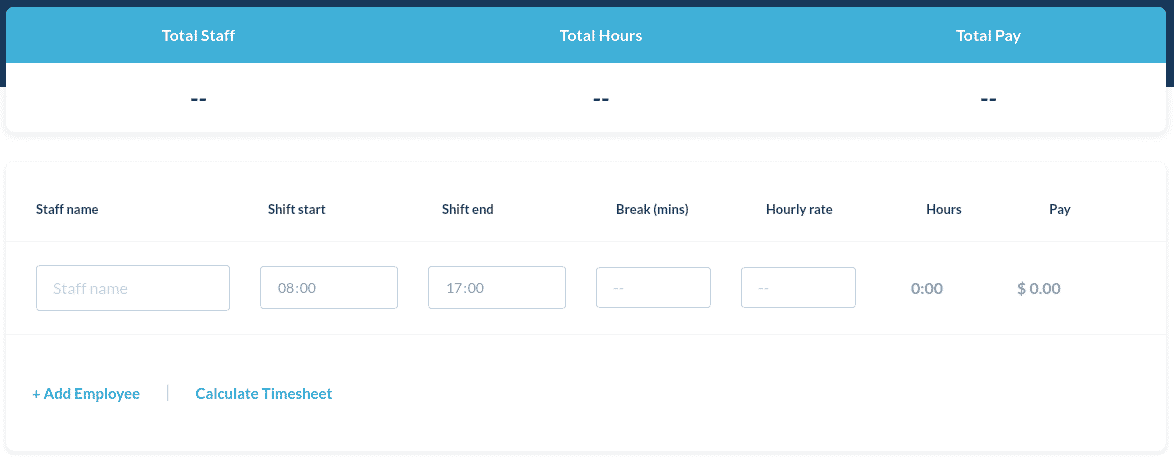

Free Timesheet Calculator For Payroll Roster Calculator Tanda Au

Payroll Tax Deductions Business Queensland

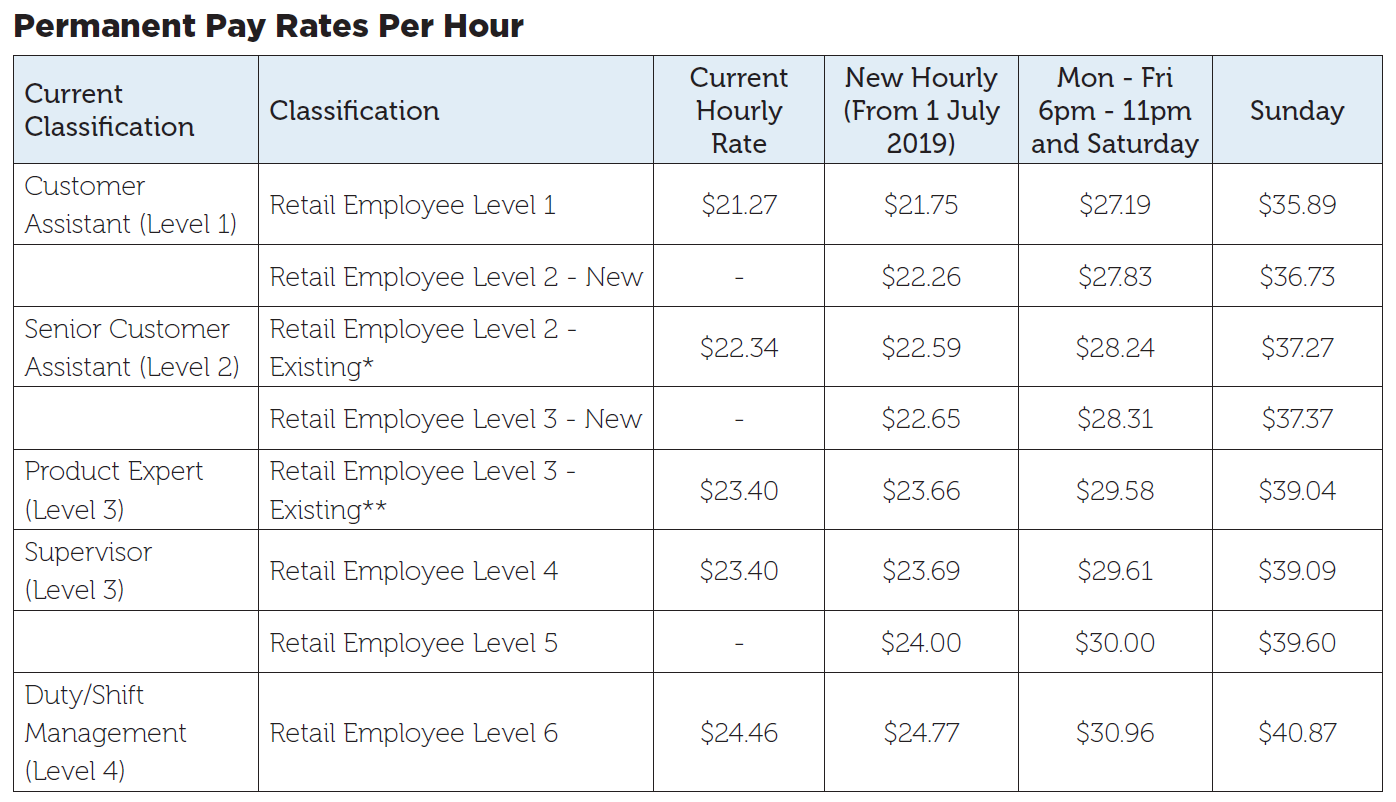

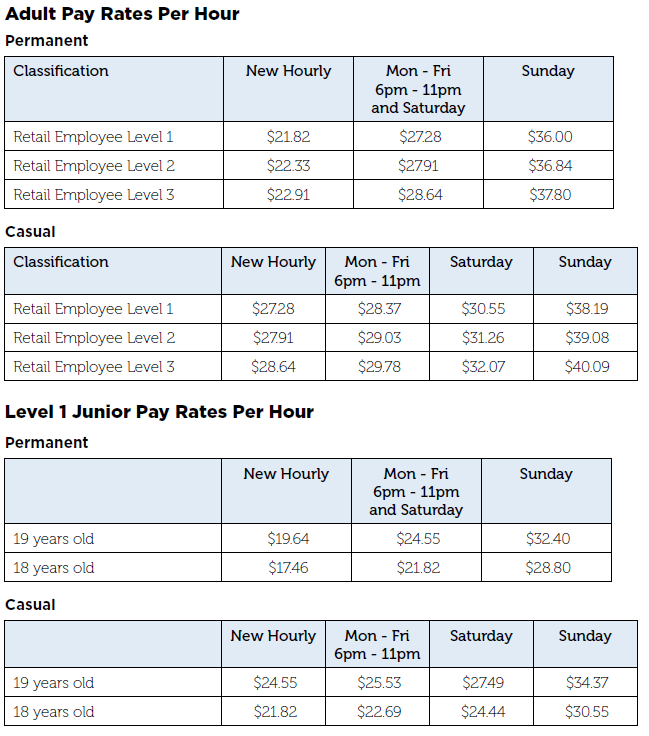

Proposed Dan Murphy S Agreement 2019 Sda Union

Bws Agreement 2019 Sda Union

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Tax The Hidden Risks Of Interstate Employees Hlb Mann Judd

Payroll Tax Deductions Business Queensland

Payroll Tax Deductions Business Queensland

Proposed Dan Murphy S Agreement 2019 Sda Union

Ytd Calculator And What Is Year To Date Income Calculator